It entrance-hundreds the curiosity, this means you spend a larger portion of the desire in the early months within your loan expression. By comprehension this calculation, you are able to better approach your loan repayment system.

The Rule of seventy eight solution differs from the more typically employed simple-desire approach, which applies your desire price continuously all over the duration of one's loan.

On account of the higher First fascination payments, the principal stability decreases in a slower rate within the early months, rendering it harder to build equity or fork out down the loan rapidly. This deficiency of adaptability might not align Using the economical objectives and circumstances of all borrowers.

This may be a downside for borrowers who want to preserve on desire by generating supplemental payments or paying off the loan early.

The time period (duration) with the loan is usually a purpose in the "Number of Payments" as well as the "Payment Frequency". If the loan is asking for every month payments along with the time period is 4 years, then enter 48 for the "Amount of Payments".

This means that borrowers can preserve on curiosity payments if they can find the money for to generate larger payments or settle the loan forward of plan.

2. Simplified budgeting: With precomputed curiosity, borrowers can certainly spending budget their month to month payments For the reason that curiosity is already factored in the loan. This will make it much easier to control finances and make sure that loan repayments are created on time.

The curiosity framework of your Rule of seventy eight is made to favor the lender in excess of the borrower. “If a borrower pays the precise total due each month for that lifetime of the loan, the Rule of seventy eight will have no effect on the entire curiosity paid out,” states Andy Dull, vice president of credit score and underwriting for Previously mentioned Lending.

By delving in to the intricacies of precomputed desire plus the Rule of 78, borrowers can navigate the lending landscape with confidence.

A helpful element to take into consideration on your calculator would be an optional area to specify a further every month payment. I’m evaluating two various insurance policies funding proposals, a person is really a regular monthly payment and the opposite is quarterly, I had been seeking to understand if we pay out an extra 200% or 300% every month the amount of we’d be conserving to the finance cost. Thanks to the Device however, probably the greatest I’ve uncovered on line.

5. Greater Total Price tag: Another disadvantage of precomputed desire is usually that it may result in an increased Over-all Expense for borrowers. Because the interest is calculated upfront and included on the loan volume, borrowers wind up paying fascination about the principal stability that would have usually been lowered if interest ended up calculated depending on the outstanding harmony.

After you’ve been accepted, you can finalize Your Loan with the lender and possess your resources deposited directly website to your banking account.

If it mentions an fascination refund, that might be described as a cue that you should request deeper questions about how your lender computes the desire in your loan. Some lenders that apply Rule of seventy eight to your loan include fine print about how it handles an interest rebate or refund in the event you elect to pay out the loan in total before the full repayment time period finishes.

Our staff frequently collects data on Every company’s loan choices and phrases, like minimum and most loan quantities, origination costs and special discounts.

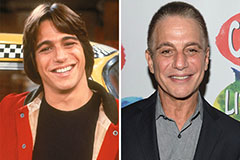

Tony Danza Then & Now!

Tony Danza Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Brooke Shields Then & Now!

Brooke Shields Then & Now!